CM Punjab Asaan Karobar Card Loan 2025 – How to Apply Online

The most important and helping Program named as Punjab Asaan Karobar Card Loan (AKC Punjab) 2025 is a special initiative that is launched by the Government of Punjab to support and to provide small business owners and entrepreneurs with very easy and cooperative access to financial support. The main aim of this program is basically to empower and enhance the business professionals by offering them the hassle-free loans that have easy return pathway through a simple registration process.

Main Loan Details for CM Punjab Loan Scheme:

Three main details that are provide here are:

Type of Loan:

“Asaan Karobar Card Loan” is basically the type of loan that is provide by the government of Pakistan to Enhance the Stability of Business Community.

Amount Range:

the range of amount that are given in this Program is Rs. 500,000–1 million. This Amount is given on different purposes.

Purpose Of this Loan:

The main purpose of this Loan is to built up the Small business setup by providing the hassle free pathway of Carrying Loan.

“Asaan Karobar” Finance Loan:

“Asaan Karobar” Finance Loan is a great incitive that is taken by the Government of Pakistan to support the Business level in Pakistan. The amount range of this loan program is Rs. 1 million up to million–30 million.

Key Features of the Punjab AKC Loan Program:

Here we will discuss the the key Features of this Loan Program.

*** The main Feature of Asaan Karobar Card Loan Offers interest-free or low-interest loans to small businesses to grow them at big level.

*** The Asaan Karobar Card Loan Program have Simple and quick online application process.

*** One of the main Feature of this AKC Program is Medium to large-scale business funding to support Business.

*** This Loan Program has Flexible repayment terms for financial ease.

*** By launching this Program Government backed and support to promote entrepreneurship.

Main QNA: What is the Punjab Asaan Karobar Card Loan (AKC Punjab)?

Here we will discuss The Punjab Asaan Karobar Card which is a financial assistance and supportive program that is basically designed to help and to grow the small and medium enterprises (SMEs) in Punjab. It provides all the needy business owners a special loan that feature flexible repayment options on minimal interest rates, that enhancing the business growth and stability.

Eligibility Criteria of AKC Punjab Loan:

One of the most important information for this Loan is the Eligibility Criteria To qualify for the Punjab Asaan Karobar Card Loan, All the applicants must fulfill these requirements:

- First necessary requirement is that applicant Must be a resident of Punjab, Pakistan.

- Applicant Must own or operate a legally approved and registered small or medium-sized business.

- A valid and Original CNIC and proof of business ownership are must required.

- Applicant Must have an active bank account for loan disbursement.

Documents Required for Registration:

Here we will discuss the details of all the required Documents to apply for this AKC Program. In order To successfully apply for the Asaan Karobar Card Loan (AKC Punjab Loan), you will need:

*** First of all a valid CNIC (Computerized National Identity Card).

*** Second one is your Recent utility bills for address verification.

*** Third One is the Proof of your business ownership (such as a business registration certificate or tax registration).

*** Main and Fourth one is a passport-sized photograph.

*** Last is the correct and valid Bank account details.

8070 Ramzan Rashan Program 2025: How to Register and Check Eligibility Online

How to Apply for the Punjab Asaan Karobar Card Loan Online?

Here we will discuss the steps by step guide for the registration process of AKC Punjab Loan Program that is simple and can be completed online by following these steps:

Step 1: Visit the Official Website:

In the first step you will have to visit the official Punjab Asaan Karobar Card Portal.

Then Navigate to the AKC Loan Registration section.

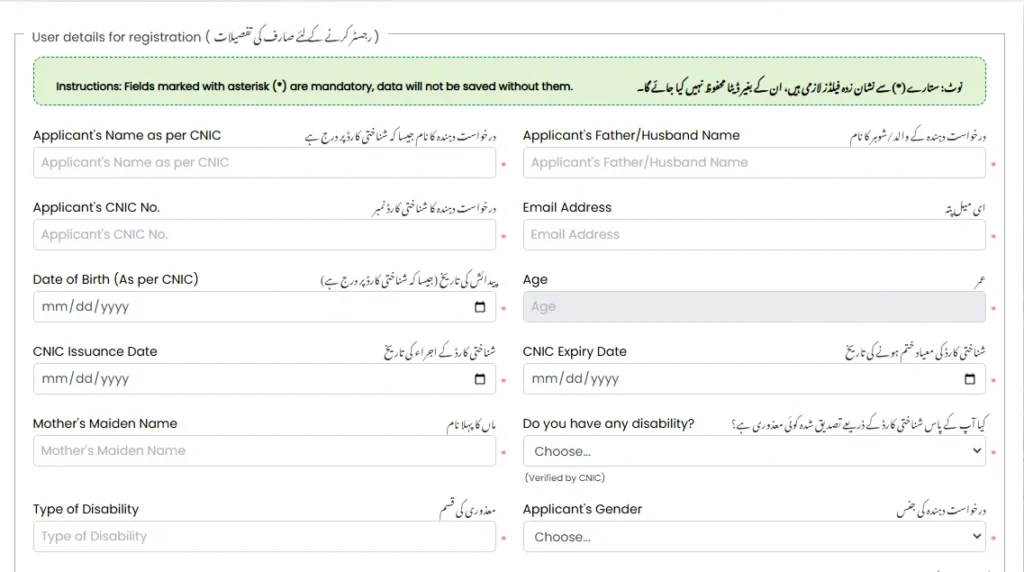

Step 2: Fill-up the Online Application Form:

In the second step you have to Enter personal details such as name, CNIC, phone number, and address.

Then you must have to Provide business-related details, including type, registration number, and annual revenue.

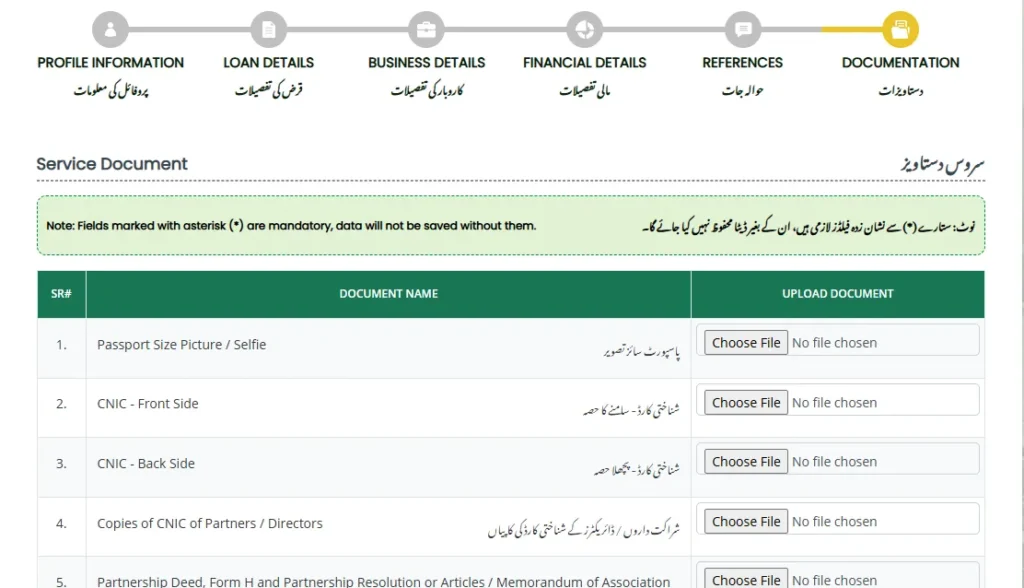

Step 3: Upload Required Documents:

In the third and main step you have to Attach the scanned copies of your CNIC, business registration proof, bank details, and all other necessary documents that are required in the application Form.

Step 4: Submit Your Application:

In the fourth Step You have to Review the provided information to make sure the accuracy.

Then Click the Submit button to complete the registration Process.

Step 5: Application Review & Loan Disbursement:

This is the last step of your application in which The Punjab Government will verify the submitted details and all the documents that you provided.

Upon the approval of your application, applicants will receive a confirmation via SMS or email.

At last the loan amount will be credited into the provided applicant’s bank account within a specified timeframe.

Final Step:

Application Fees:

Here are the two types of fee for different type of Loan Application.

Type 1 Loan Application Fee: PKR 5,000 (Non-Refundable)

Type 2 Loan Application Fee: PKR 10,000 (Non-Refundable)

BISP 8171 Web Portal Online – March 2025 New Qist Payment Status, Eligibility Check

Frequently Asked Questions (FAQs):

Here is the detail of all the FAQS about this AKC Program

1. Who can apply for the Punjab AKC Loan?

This is very important to mention that only the Residents of Punjab who own a legally registered small or medium-sized business can apply for this Loan Program.

2. Are these AKC Punjab loans are interest-free?

It is noted that Some of the AKC loans are interest-free, while others come with minimal interest rates.

3. How long does the approval process of AKC Loan take?

The Approval of this Loan Program usually takes a few weeks, depending on document verification and the amount of Loan that you need.

4. Can I apply for the Loan without a registered business?

It is very Clear to mention that only legally registered businesses are eligible for this loan.

5. How can I check my application status?

All the Applicants can easily track their status of application by logging into the Punjab Government’s official portal.

Conclusion:

It has been Conclude that The Punjab Asaan Karobar Card Loan (AKC Punjab) is such a valuable, initiative and supportive Program that aimed to helping small business owners by securing financial support with ease. With a Quick and easy online application process and quick disbursement, entrepreneurs and Businessmen can grow and sustain their businesses effectively.

Note: It is hereby Noted that If you are a business owner in Punjab, then you must have to take advantage of this opportunity by registering Yourself for the AKC Punjab Loan Program today and giving your business the financial boost that your business deserves.